b&o tax states

Our Premium Calculator Includes. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level.

Why Our B O Tax Is Unfair R Seattlewa

This article authored by Scott Schiefelbein and Robert Wood 2 provides helpful tips regarding some of the nexus traps the BO tax poses for the.

. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Our BO tax tripled when that went away he notes. Washington State BO Tax Treatment.

The Washington Department of Revenue Department recently adopted emergency rule amendments to Washington Administrative Code WAC 458-20-19404. There are two BO tax classifications that apply to income received from operating contests of chance. V voter approved increase above statutory limit e rate higher.

A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad. The new tax is. The department assigns a reporting frequency for filing returns based on estimated yearly tax due and type of.

Connecticut 154 percent and Hawaii 149 percent followed. The Washington Policy Center an independent. Under GAAP for-profit enterprises have several allowable accounting conventions to record the ERC credit.

Business registration is done through the State of Washington Business Licensing Service. This Washington BO tax threshold is applicable for all business classifications. It is measured on the value of products gross proceeds of sale or gross income of the.

Business and occupation tax overview. Contact the city directly for specific information or other business licenses or taxes that may apply. The tax amount is based on the value of the manufactured products or by-products.

Our Premium Calculator Includes. Businesses with 150000 or more in revenues attributable to Ohio are responsible for paying Ohio Gross Receipts Tax Commercial Activity Tax either annually or. From the Washington Department of Revenue.

Washington is the only state in the country that taxes businesses this way. The state BO tax is reported on the Department of Revenues excise tax return. The relationship between the state BO tax and the local BO taxes is similar at least in concept to the sales tax.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. So for example if you pay ServiceOther B O annually and your annual. The tax amount is based on the value of the manufactured products or by-products.

The worst case scenario under the new law exists for Washington based service businesses that have non-Washington customers and dont file tax returns or exceed any of the above. Business and Occupation Tax. A one-time 4000 city.

Delap advisors have an 87-year history of offering trusted and reliable state and local tax. The BO tax for labor materials taxes or other costs of doing business. As your income goes up you get a smaller and smaller credit until you make enough to pay the full percentage.

New Yorkers faced the highest burden with 159 percent of net product in the state going to state and local taxes. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Washington has a state sales tax rate of 65 which is.

Have a local BO tax. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. The state BO tax is a gross receipts tax.

Gambling Contests of Chance less than 50000 a year rate 15 percent. However on May 4 2021 Washington Governor Jay Inslee signed Senate Bill 5096 into law in an effort to make the Washington tax system more equitable to all residents.

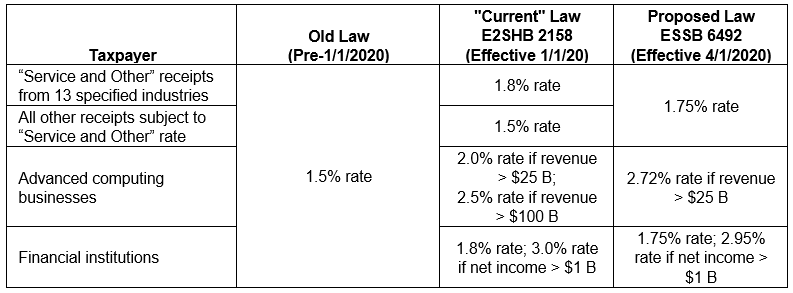

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

B Amp O Tax Guide City Of Bellevue

Business And Occupation B O Tax Washington State And City Of Bellingham

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Baltimore Ohio B O Coal Dock At Lorain Ohio By Doug Lilly

N747bc Boeing 747 4j6 Lcf Boeing Company Brock L Jetphotos

When Are Washington S Business Occupation B O Taxes Due 2021 Youtube

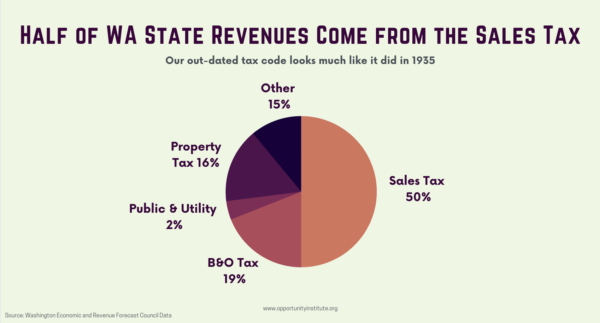

A Quick Guide To Washington S Tax Code Economic Opportunity Institute Economic Opportunity Institute